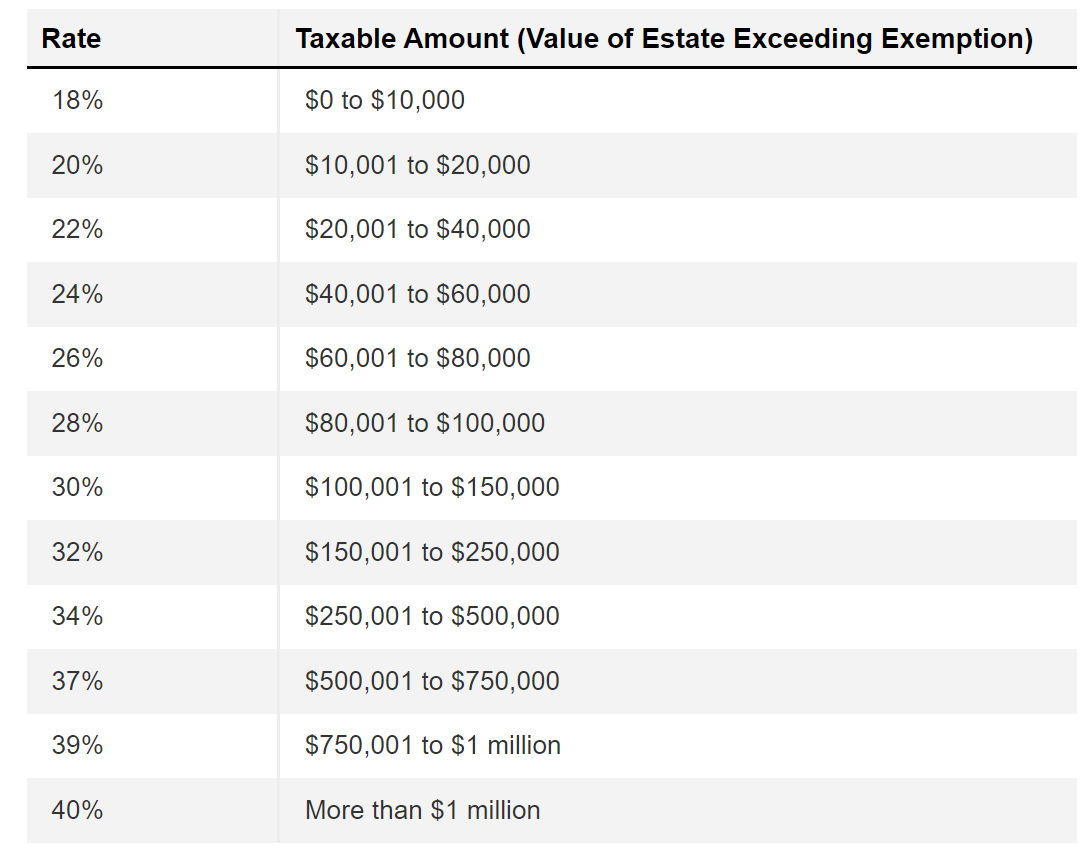

Gift And Estate Tax Exemption 2025. The exemption from gift and estate taxes is now just above $13.6 million, up from about $12.9 million last year. Finance minister nirmala sitharaman is likely to present union budget 2025 this month.

There’s no limit on the number of individual gifts that can be made, and couples can give double that amount if they elect to split gifts. Let us know more about gifts and income tax applicable on gifts in india.

Any tax exemption from rental income will also encourage greater investment in residential real estate.

The 2025 Estate & Gift Tax Exemption Amount Set to Rise Again Geiger, The federal estate tax exemption amount went up again for 2025. The gift tax annual exclusion in 2025 increased to $18,000 per donee.

Federal Estate Tax Rates 2025 Norah Annelise, This is the dollar amount of taxable gifts that each person can make while. Gifts in other cases are taxable.

2025 Estate and Gift Tax Exemptions Paul Premack, Probate & Estate, The 2025 annual exclusion amount will be $18,000 (up from $17,000 in 2025). To sum it up, budget 2025 could see significant changes aimed at making the new income tax regime more attractive by increasing deductions and raising exemption limits, thereby providing greater relief and incentives for taxpayers to switch.

2025 Gift Tax Lifetime Exemption Sybil Euphemia, To sum it up, budget 2025 could see significant changes aimed at making the new income tax regime more attractive by increasing deductions and raising exemption limits, thereby providing greater relief and incentives for taxpayers to switch. In addition, gifts from certain relatives such as parents, spouse and siblings are also exempt from tax.

IRS Raises Estate Tax Exemption Amount for 2025 ShindelRock, The 2017 tax cuts and jobs act (tcja) nearly doubled the lifetime estate and gift tax exemption from $5.6 million to $11.18 million for individuals, indexed for inflation after 2018. A higher exemption means more estates may be exempt from the federal tax this year, which can save heirs from a hefty tax.

Client Alert 2025 Estate and Gift Tax Exemptions Bulman, Dunie, There's no limit on the number of individual gifts that can be made, and couples can give double that amount if they elect to split gifts. A married couple filing jointly can double this amount and gift individuals $36,000 apiece in 2025.

Federal Estate and Gift Tax Exemption Regarding Current Gifts, This is the dollar amount of taxable gifts that each person can make while. The 2025 annual exclusion amount will be $18,000 (up from $17,000 in 2025).

Why Now May be the Right Time for Estate Tax Planning, Elevated gift tax exclusions will sunset after 2025. These changes generally apply for tax returns filed in 2025.

Increased 2025 Gift and Estate Tax Exemption Amounts What You Need to, A married couple filing jointly can double this amount and gift individuals $36,000 apiece in 2025. 50,000 per annum are exempt from tax in india.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, Finance minister nirmala sitharaman is likely to present union budget 2025 this month. The new year inevitably brings changes to the federal estate tax exemption and gift tax exemption amounts, which continue to rise with inflation.

A higher exemption means more estates may be exempt from the federal tax this year, which can save heirs from a hefty tax.